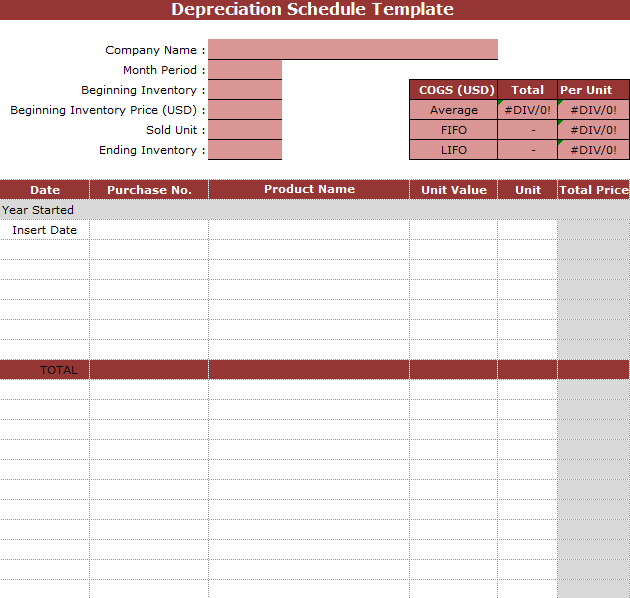

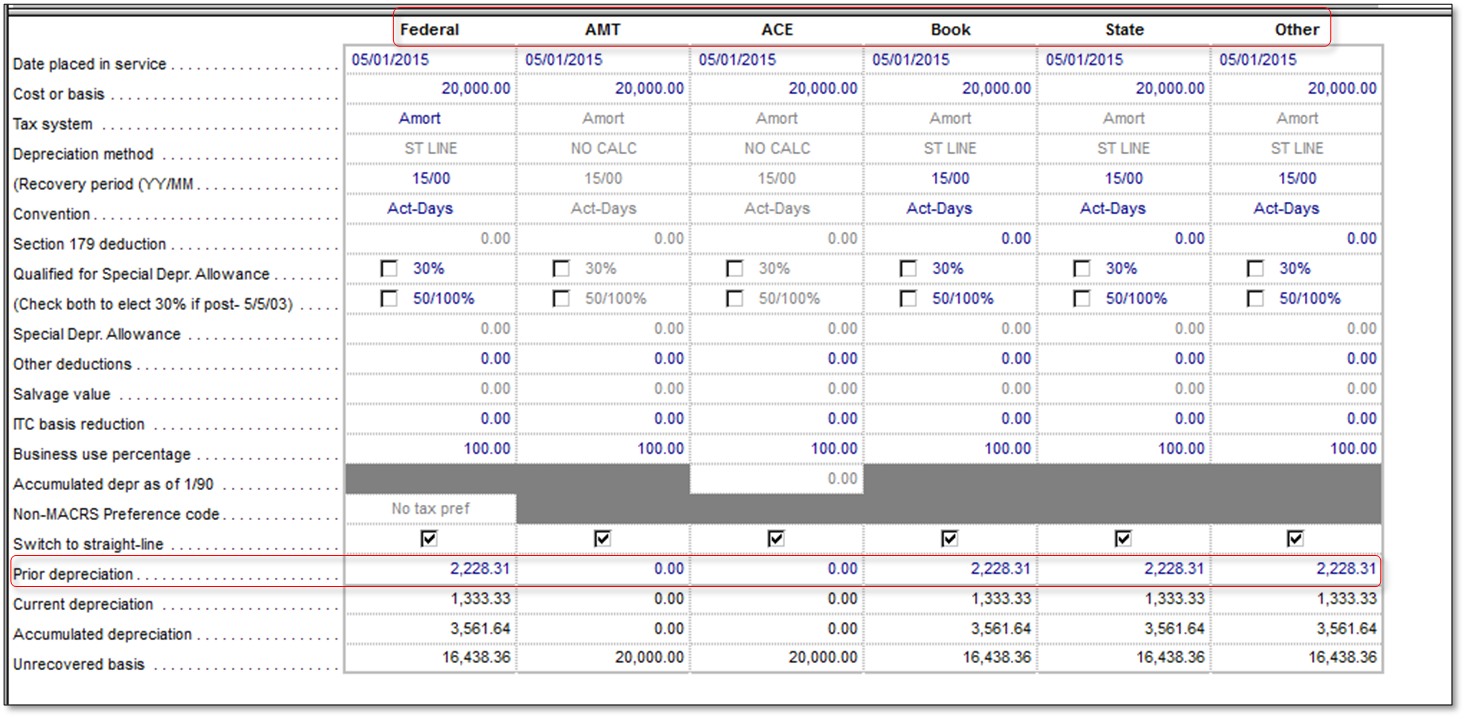

Fixed Asset Depreciation Schedule Excel. Includes straight-line depreciation and declining balance depreciation methods for financial Depreciation is a term used to describe the reduction in the value of as asset over a number of years. This Excel Fixed Assets Depreciation Schedule automates the tracking of the balance of your fixed assets and record your depreciation expense on a straight-line basis based on the number of days.

Straight line depreciation is the most basic type of depreciation.

It allows you to record fixed assets of a small business over a period of years and calculate the depreciation each year.

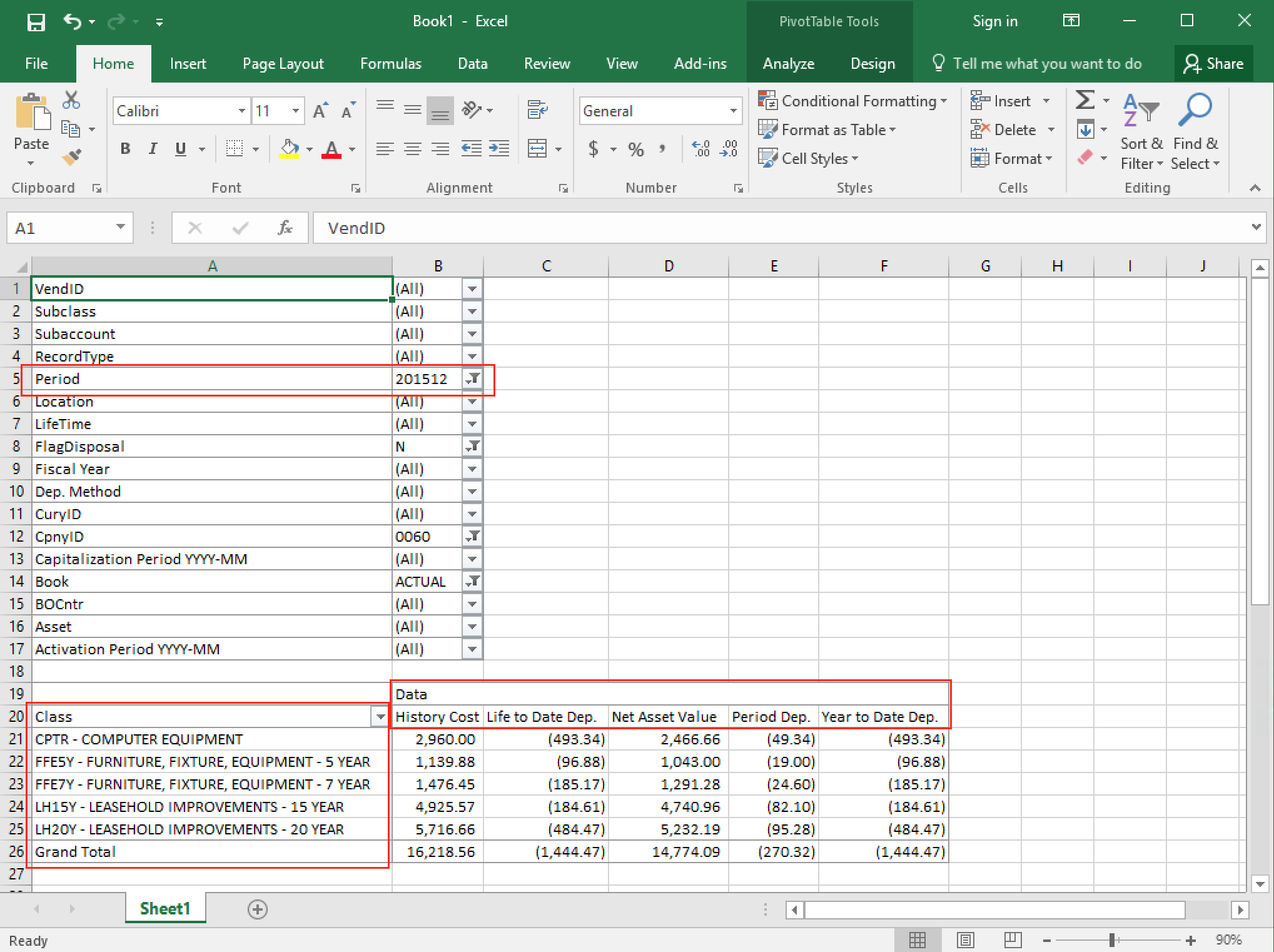

How to use the fixed assets schedule from AccountingExL for accounting and to reconcile fixed assets in Microsoft Excel. How to calculate depreciation for fixed assets with the straight-line method, the sum of the year's digits method, and others, using Microsoft Excel. It is an important component in the calculation of a depreciation schedule.

0 komentar:

Posting Komentar