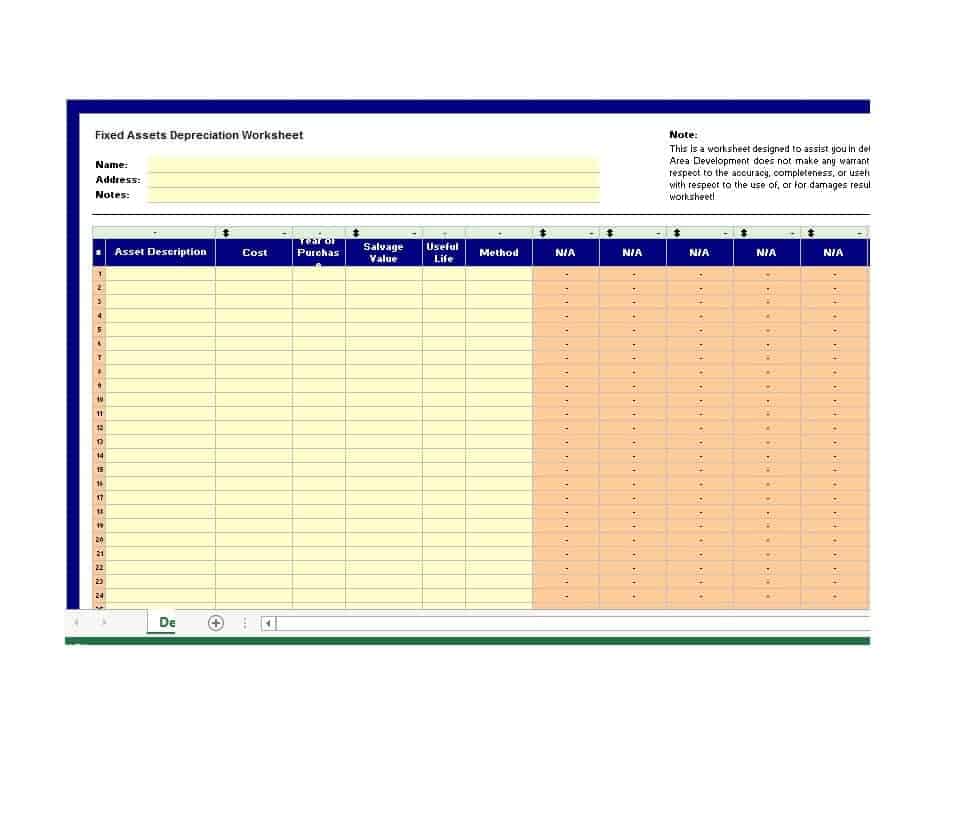

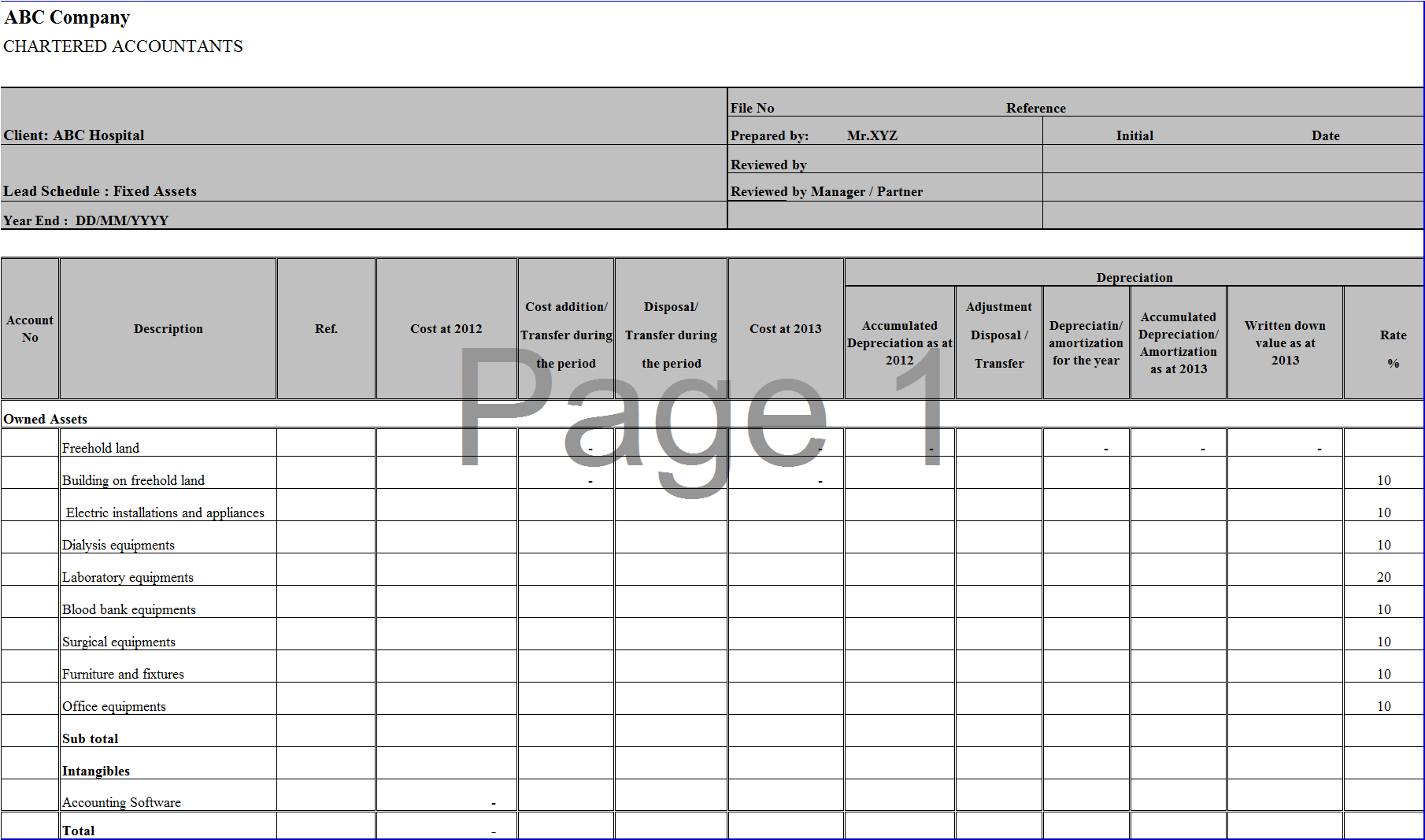

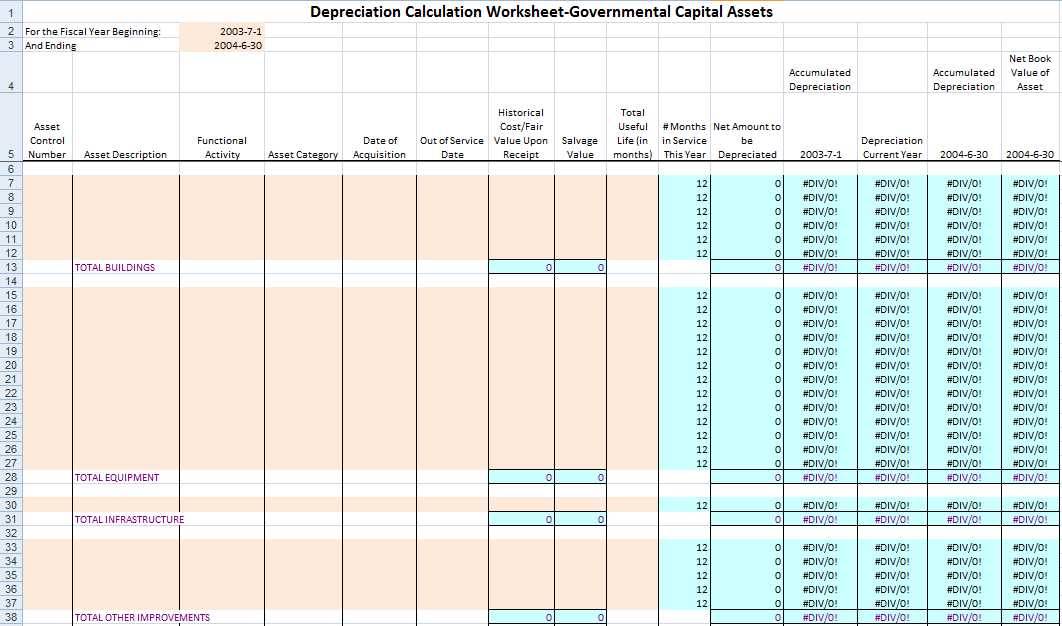

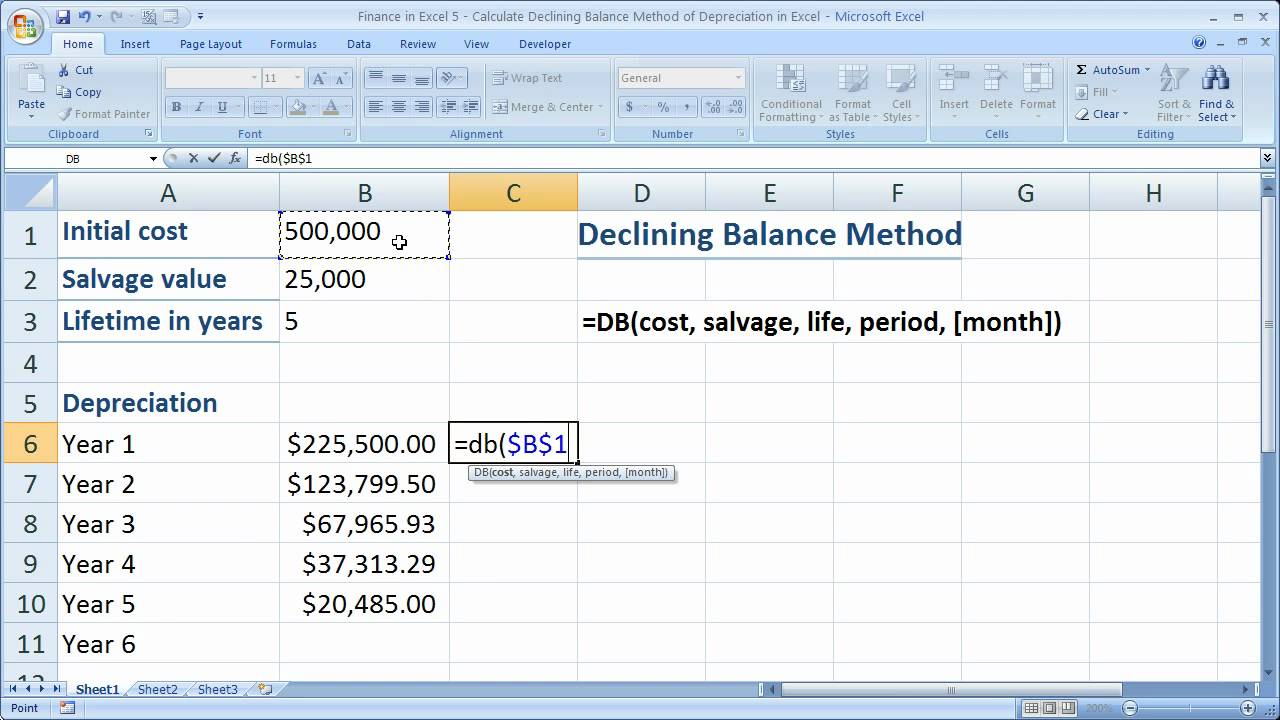

Depreciation Format In Excel. These built-in depreciation functions found on the Financial button's drop-down menu on the Formulas tab of the Ribbon include the following Microsoft Excel has built-in depreciation functions for multiple depreciation methods including the straight-line method, the sum of the years' digits method, the declining balance method (the DB function), the double-declining In Excel, the function SYD depreciates an asset using this method. Excel can accomplish both using the SLN function to calculate the straight line -- a standard rate of depreciation -- and the DDB function to Microsoft Excel is a widely used spreadsheet program that can use formulas to compute and display values.

These built-in depreciation functions found on the Financial button's drop-down menu on the Formulas tab of the Ribbon include the following Microsoft Excel has built-in depreciation functions for multiple depreciation methods including the straight-line method, the sum of the years' digits method, the declining balance method (the DB function), the double-declining In Excel, the function SYD depreciates an asset using this method.

You can apply formatting to an entire cell and to the data inside a cell—or a group of cells.

Make sure you use a minus sign (-) with Date and time values are stored as numbers in Excel. When you enter a date, Excel automatically converts it into a numerical value, and then. In Excel user can calculate the depreciation of an asset in the given time period.

0 komentar:

Posting Komentar