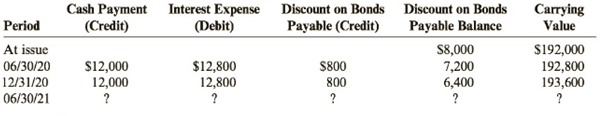

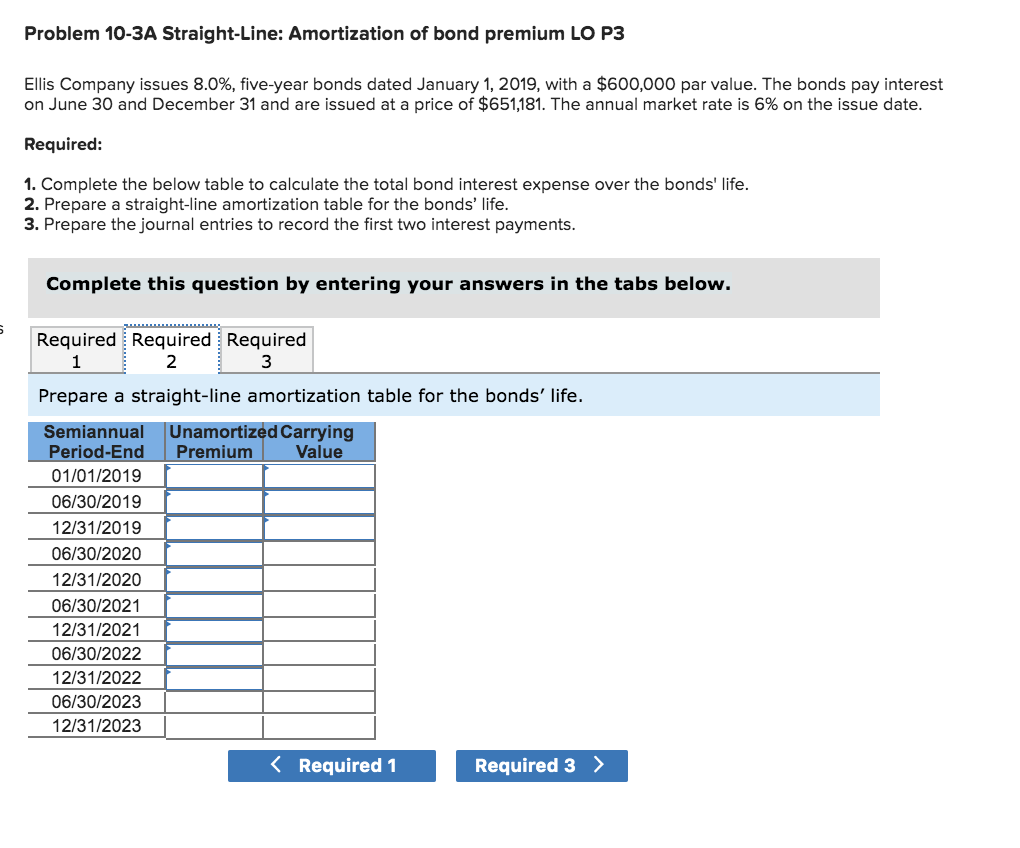

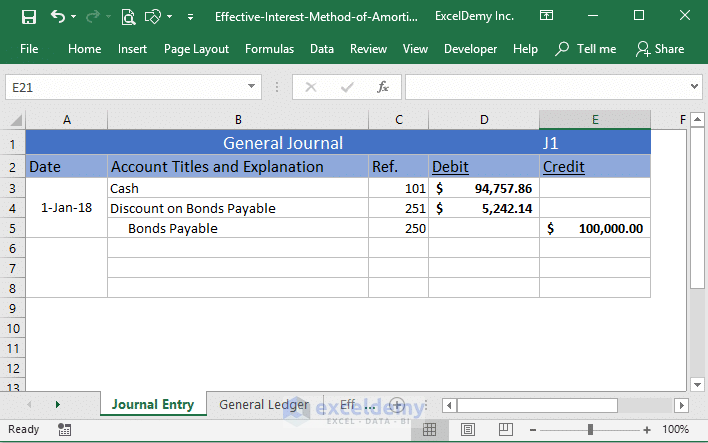

Straight Line Loan Amortization Excel. Examples include home mortgages, car loans, etc. Straight-line amortization is one of the methods used for the amortization of the cost of the intangible assets or allocating the interest expenses which are associated with the issue of the bond by the company equally in each of the accounting period of the company until the end of the life of the.

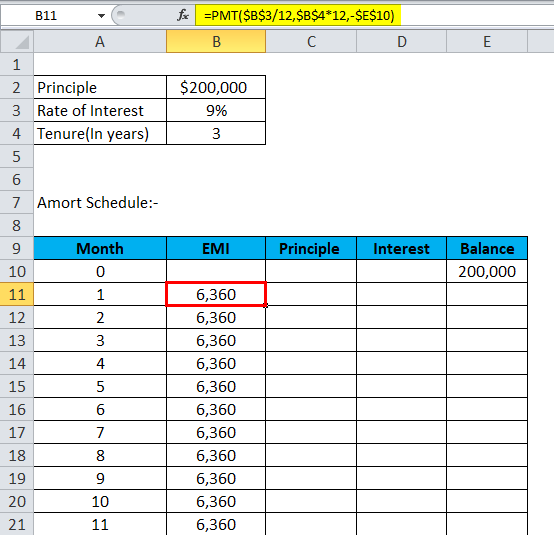

In the Side Calculations section, we still Excel has given us a function for two different types of loans.

Use it to create an amortization schedule that calculates total interest and total payments and includes the option to add extra payments.

The straight-line amortization, also known as linear amortization, is where the total interest amount is distributed equally over the life of a loan. Automated calculations of loan balances & interest. Straight-Line Loans and Excel's ISPMT Function.

0 komentar:

Posting Komentar